Effective annual yield calculator

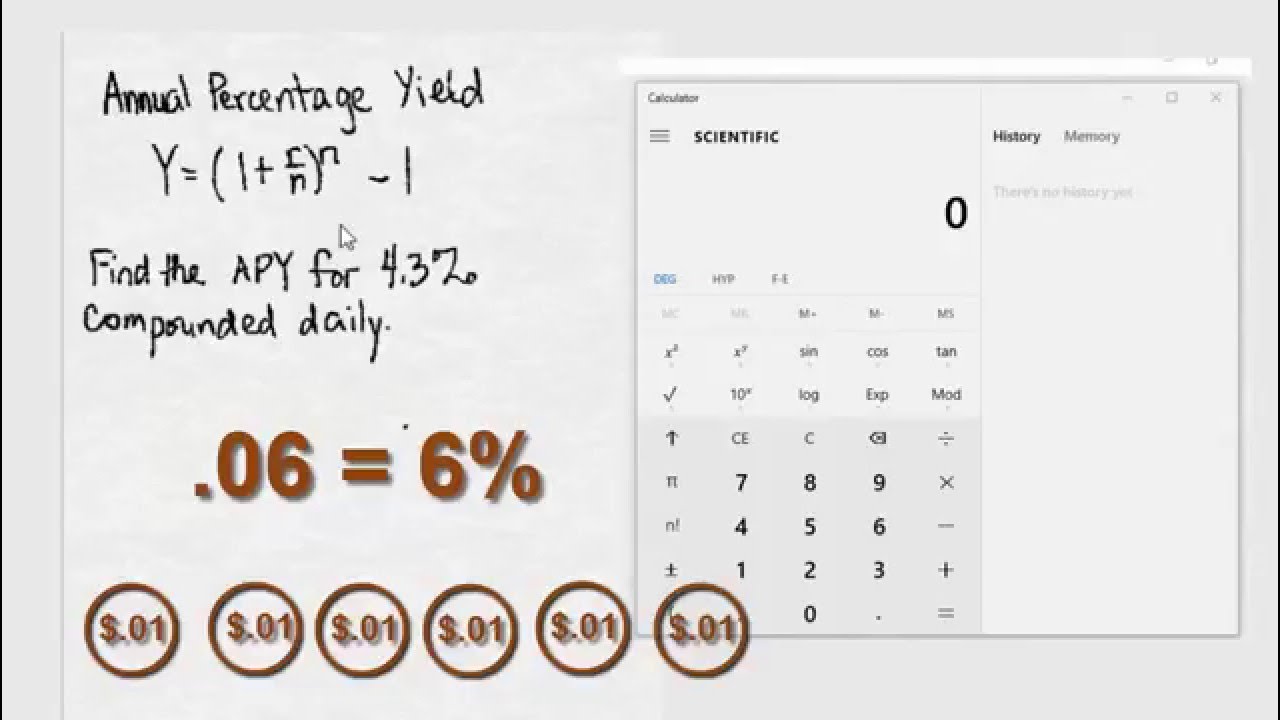

APY 1 rnn - 1. First enter the percentage value of the Interest.

Effective Annual Rate Calculator Ear Calculator Academy

Build Your Future With a Firm that has 85 Years of Investment Experience.

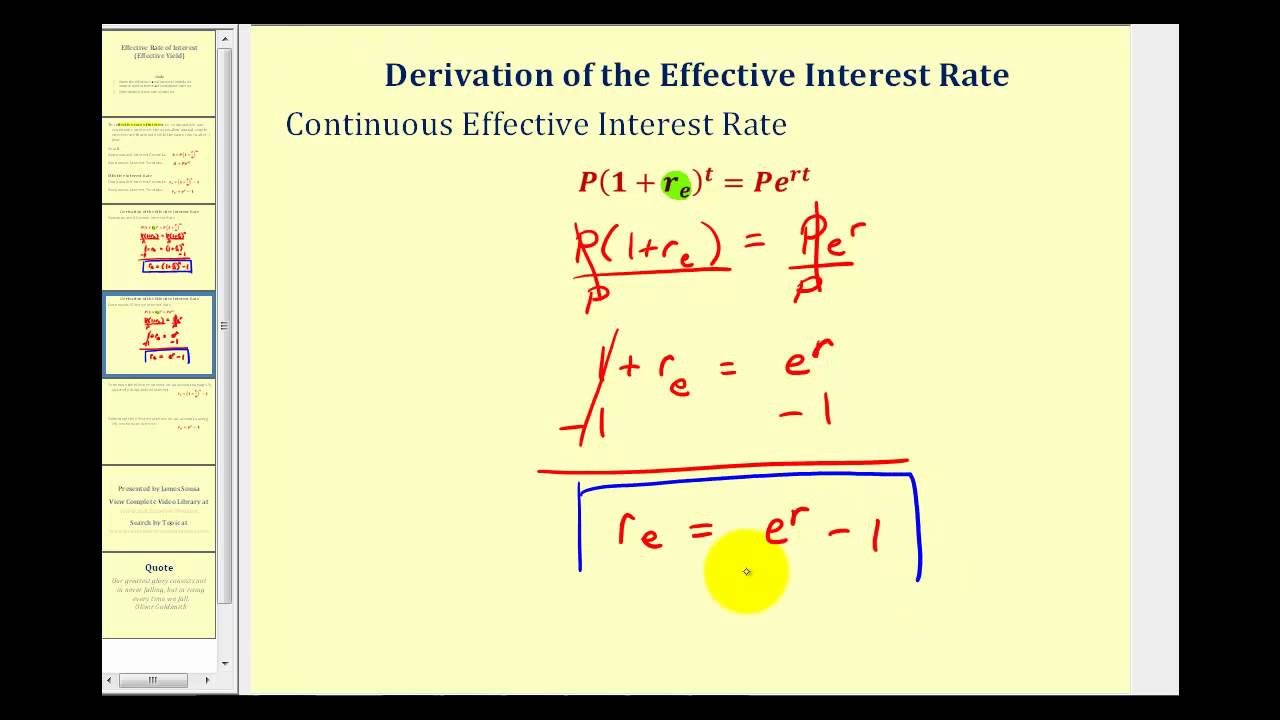

. R stated annual interest rate. For example if an investment compounds daily it will earn more than the same investment with the same statednominal rate compounding monthly. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

The last step is to calculate the effective annual yield using the effective annual yield equation. Effective annual yield 1 coupon. Use this calculator to determine the.

Using our US T-Bill Calculator below you are able to select the face value. The Effective Yield Calculator is used to calculate the effective yield which is an annual rate of return associated with a periodic interest rate based on the. Thus we can see as the compounding.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Do Your Investments Align with Your Goals. The APY Calculator is a tool which enables you to calculate the actual interest earned on an investment over a yearAnnual interest yield APY is a measurement that can be.

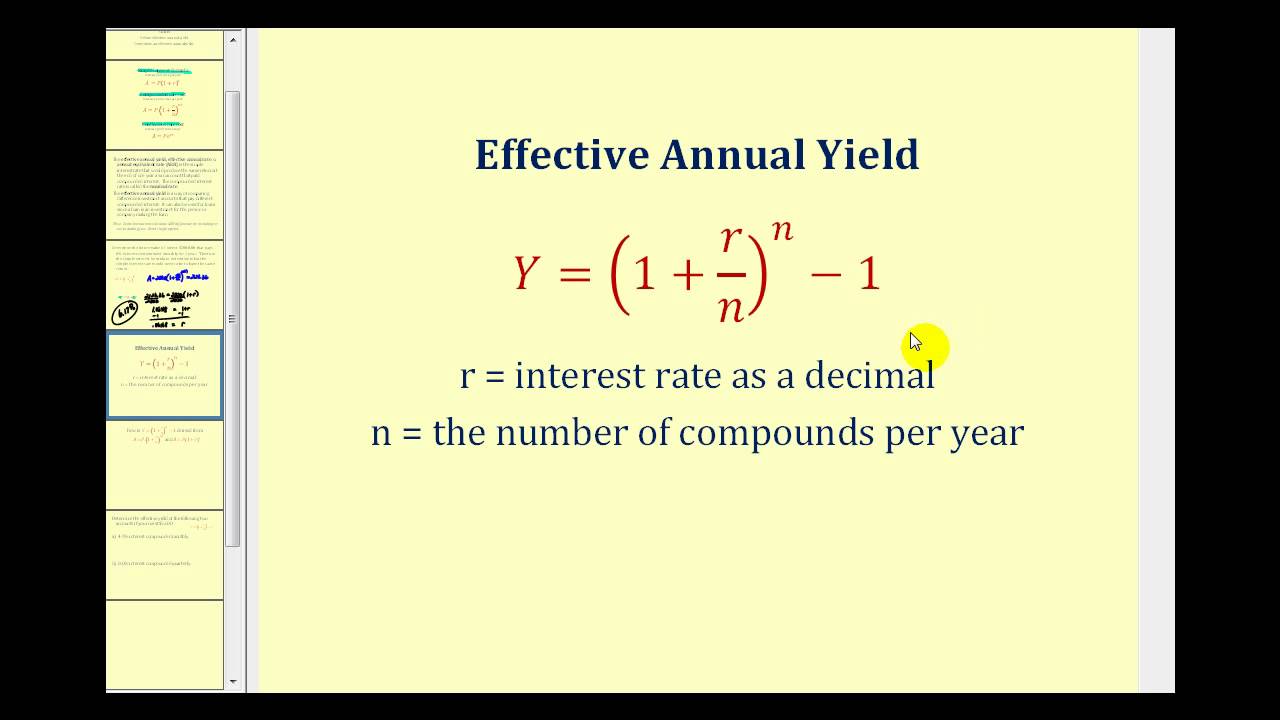

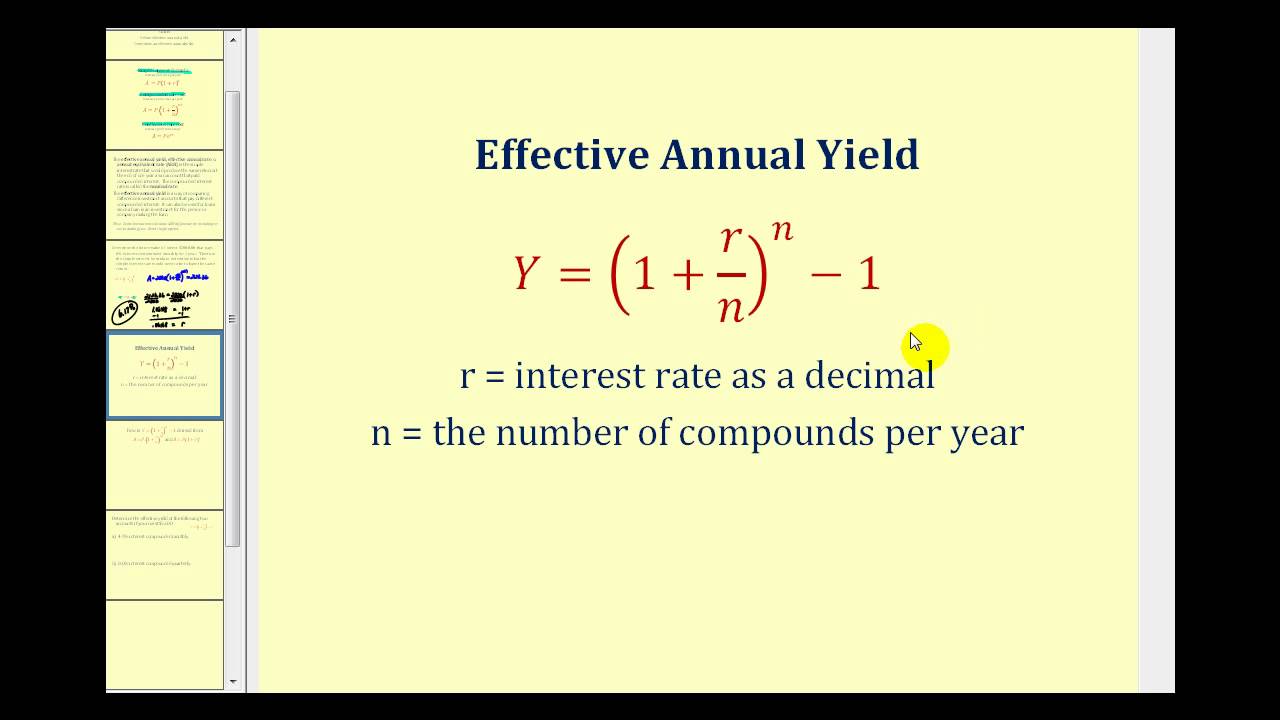

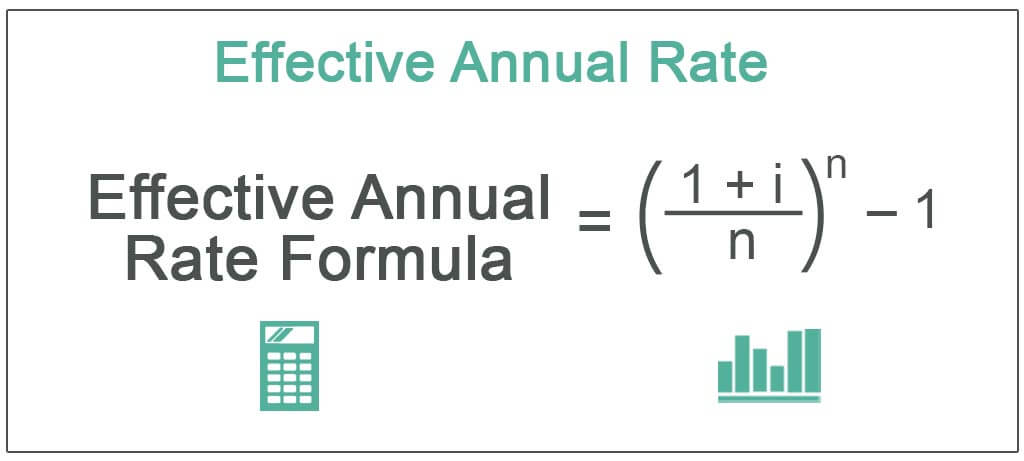

About Effective Yield Calculator. Annual percentage yield APY is the effective annual rate or real rate of return of an investment if the interest earned each period is compounded. N number of compounding periods per year.

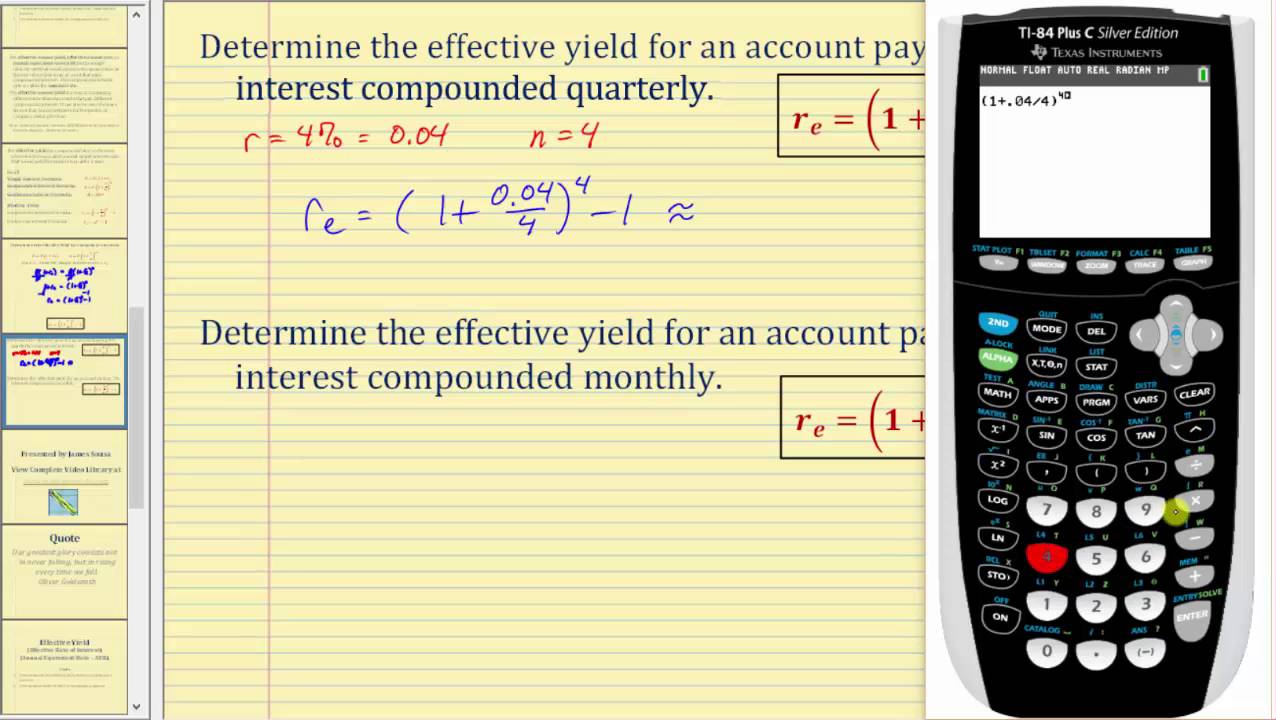

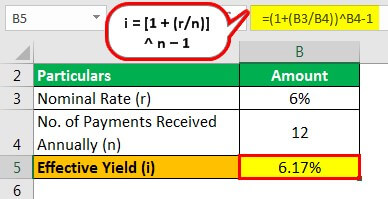

Then select the Compounding option from the drop-down menu. 498541439 00498541439 x 100 Based on the above example an interest-bearing account paying a stated nominal or annual interest rate of 4875 compounded monthly. Effective annual yield 1 rnn 1.

Example of Effective Annual Yield Rate. APY considers the effects of compounding. Where APY Annual Percentage Yield.

In the yield to maturity calculator you can choose. You could be earning more interest with a Capital One CD account. Therefore EAY 00834 or 834.

To see how the number of annual coupon payments received affects the. Calculate the effective annual yield. Nominalstated annual interest rate 0 to 40 Number of compounding periods per year.

Annual interest rate of a firm is 10 compounded monthly payments then what is the effective interest rate of the firm. Ad The numbers dont lie. Find a Dedicated Financial Advisor Now.

Treasury Bills are normally sold in groups of 1000 with a standard period of either 4 weeks 13 weeks or 26 weeks. Plugging in the calculation formula you calculate the yield as follows. Use this calculator to determine the effective annual yield on an investment.

Decide when your CD account interest is paid outend of term monthly or annually. 1 072 2 1 7123. Coupon rate is the annual interest you will receive by investing in the bond and frequency is the number of times you will receive it in a year.

Effective annual yield 1 812 12 1 1 000667 12 1 10834 1. Here are the steps to follow for this annual percentage yield calculator. I Effective Interest Rate.

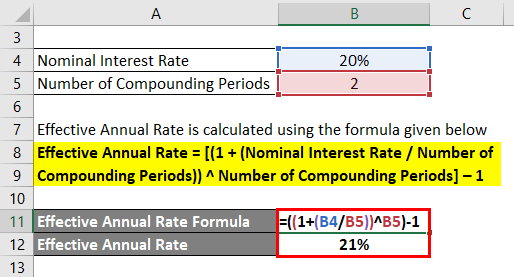

Effective Annual Rate Formula Calculator Examples Excel Template

Effective Interest Rate Effective Yield Youtube

How To Calculate Effective Interest Rate 8 Steps With Pictures

Determining The Effective Yield Of An Investment Youtube

Effective Annual Yield Calculator Discount 53 Off Www Ingeniovirtual Com

Effective Yield For Compounded Interest Youtube

Effective Yield Definition Formula How To Calculate

Effective Annual Rate Ear Definition Examples Interpretation

Apy Calculator

/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg)

Stated Annual Interest Rate Definition

Effective Annual Rate Formula Calculations Video Lesson Transcript Study Com

Excel Formula Effective Annual Interest Rate Exceljet

Effective Annual Yield Calculator Calculator Academy

Effective Annual Yield Calculator Online 50 Off Www Ingeniovirtual Com

Effective Yield Definition Formula How To Calculate

Excel Finance Class 48 Calculate Ytm And Effective Annual Yield From Bond Cash Flows Rate Effect Youtube

Effective Annual Rate Formula Calculator Examples Excel Template